Welcome to the fourth edition of my annual budget as a full-time professional triathlete! Much to my initial surprise, these posts about my finances have become perennial favourites. Perhaps this reflects our collective obsession with money or the almost voyeuristic thrill of peeking into someone else’s finances.

The past year was a tough one for me, both professionally and personally. In terms of race performance, 2017 felt like the first hiccup in what had been a steady upwards trajectory over my first three years as a pro. Off the race course, it was also a tumultuous year, one that unceremoniously booted me from adolescence into adulthood… or at least pretend adulthood… A good deal of this drama revolved around the odyssey that was my first home purchase, recounted later.

Despite some challenges, I’ve come a long way since I made this bleak observation in my first year budget:

The earnings prospects for a rookie pro triathlete fall somewhere in between “unskilled illegal immigrant” and “preteen babysitter”.

Through some combination of masochism willingness to suffer, wheeling and dealing entrepreneurship and the relentless pursuit of greatness genetics, plus healthy measures of good fortune, opportunity and privilege, I’ve somehow managed to spin a glorified hobby into a full-time career. Six years ago, as a freshly minted physics graduate, this certainly wasn’t the career path I had envisioned. Yet I find myself tumbling deeper down the rabbit hole that is triathlon every year and relishing the adventure!

These budget posts are best appreciated as a series, so I suggest starting at the beginning or giving yourself a refresher.

My Third Year Pro Triathlon Budget

2017 Budget

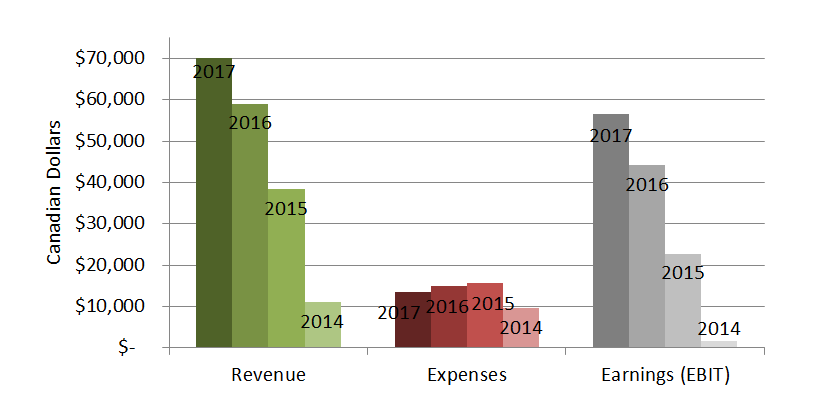

Despite a season of ups and downs, 2017 was my most financially successful year to date. Total earnings increased by about 20% to CA$70,000. This was driven by major increases in sponsorship, which more than offset weaker earnings from prize money, i.e. I raced more erratically but hustled harder.

Revenue, expenses and earnings before interest and taxes (EBIT) from triathlon over my four years as a professional are summarized below. Throughout this post, I’ll present dollar figures in both Canadian and US dollars (converted at the average annual exchange rate) since the majority of my revenue and expenses are in US dollars though I live and pay taxes in Canada.

| 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|

| Triathlon revenue | CA$70,167

US$54,033 |

CA$59,076

US$44,619 |

CA$38,288

US$30,030 |

CA$11,090

US$10,047 |

| Triathlon expenses | CA$13,514

US$10,407 |

CA$14,976

US$11,311 |

CA$15,559

US$12,203 |

CA$9,544

US$8,646 |

| Earnings (EBIT) | CA$56,652

US$43,625 |

CA$44,100

US$33,308 |

CA$22,729

US$17,827 |

CA$1,546

US$1,400 |

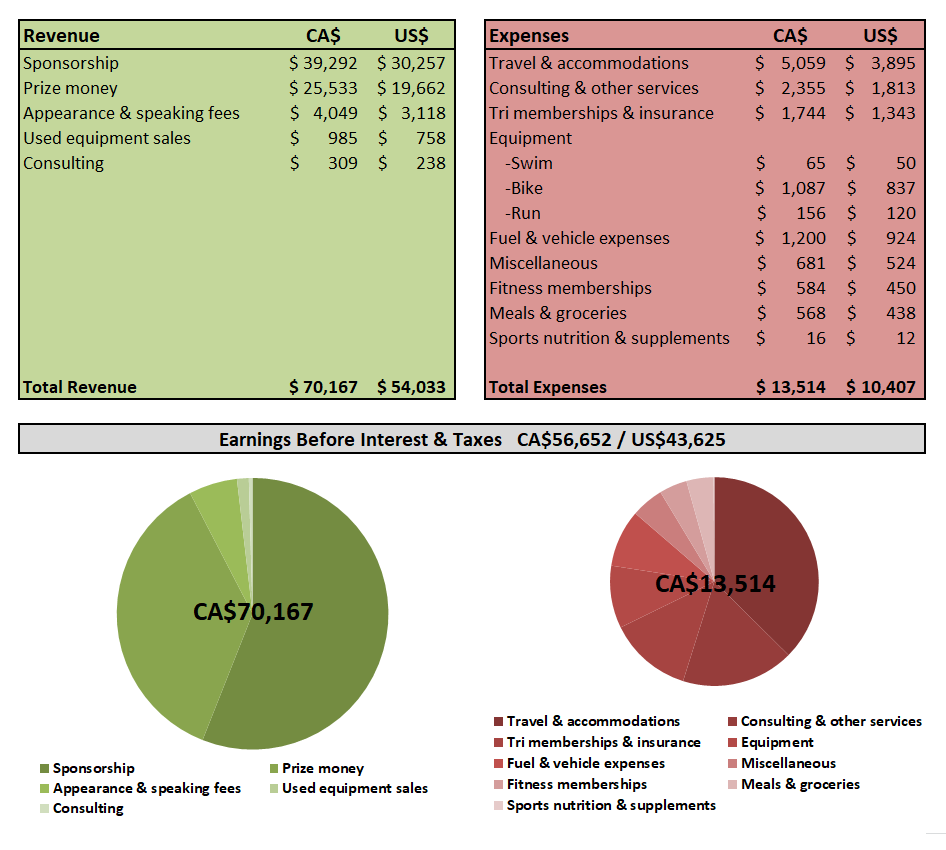

A detailed breakdown of my 2017 triathlon budget is shown below. Like previous budgets, this one strictly includes triathlon-related revenue and expenses, and not my modest earnings from consulting work and investments or my living expenses, which are itemized separately in the next section.

This was the second year that my triathlon career alone provided a relatively comfortable income. My earnings from triathlon (after expenses, before tax) of CA$56,652 are well above the Canadian median individual income and enough to provide a good standard of living in all but North America’s most expensive cities. This assertion may raise some eyebrows among my well-heeled readers, but let’s not forget that amateur triathletes—unlike pros—are an inordinately wealthy demographic. I could certainly figure out how to spend more money, but my motivation to earn more would probably drop off precipitously over about $100,000. If wealth were a personal priority, I chose the wrong line of work!

Revenue

Sponsorship

Looking back over a frustrating season, sponsorship is one of the few areas where I can pat myself on the back. I worked hard to secure new contracts and improve existing relationships. Revenue from sponsorship more than tripled from 2016 to $39,292, eclipsing total prize money for the first time. In my rookie 2014 season, I didn’t earn a cent from financial sponsorship (excluding in-kind and travel contributions). The following year, about 10% of my income came from cash sponsorship, growing to 20% in 2016 and a whopping 56% last year.

I’ve written at length about sponsorship in past budget posts, so I’ll try to touch on some new points. I’ve learned that it takes years of patience and hard work to build a reputation and image, develop a network, earn the trust of sponsors and nurture these relationships. I was honoured to renew all my contracts from the previous year, since long-term relationships are always my objective. Some of my largest deals gradually developed from very humble beginnings, often starting as product-only deals.

While I can’t discuss specifics of individual contracts, I can make some general observations. More recently, there has been a shift in my sponsor contracts towards paying an annual salary/stipend as opposed to other forms of compensation such as performance bonuses or expense allowances. In 2018, my basic living expenses will be covered by sponsorship before I even set foot on the race course. This is a welcome milestone compared to the tense situation of relying mostly on racing to pay the bills. I like to have a mix of contract types among my sponsors, similar to the philosophy behind a balanced investment portfolio. Some sponsors pay fixed compensation, some reward performance, many are a hybrid of the two and others feature different incentives. I even acquired a small amount of equity from a sponsor, an entirely new form of compensation for me. This diverse “sponsorship portfolio” hedges against the inevitable ups and downs in race performance and provides a measure of income security.

I’ve also seen a greater range of opportunities open up in the world of sponsorship, particularly with non-endemic (i.e. non-triathlon industry sponsors). No two of my contracts are alike, each emphasizing different services such as social media support, appearances and speaking engagements, research and development, photo/video shoots and modeling, writing and more.

I continue to be extremely particular about the companies I partner with, especially now that my roster of ten sponsors is practically full. For every ten opportunities that come across my desk, only about five are serious, only a few merit more careful consideration and only one actually amounts to a deal. I always have room for another compelling opportunity. Right now, an environmental sponsor such as a carbon offset company and an apparel sponsor top my wish list. (/self-promotion)

In last year’s budget post, I outlined why I stubbornly resisted working with an agent. It boiled down to two reasons: 1) there’s wasn’t really enough money to go around, and 2) I enjoy the process of courting sponsors, negotiating deals and personally maintaining these relationships. Faced with increasing distractions and responsibilities, plus larger deals, I changed my tune. I recently began working with Claire Duncan, a rising name in the triathlon business world, a smart decision that is already paying off.

Prize Money

Unlike sponsorship, this was the first year that prize money didn’t increase. In fact, I earned about 36% less from prize money than 2016 despite overall increases in revenue. This was skewed by my two wins in 2016 (Ironman 70.3 Eagleman & Ecuador) which accounted for nearly half my income that year, compared to only one win in 2017 (Challenge Aruba). Wins are disproportionately lucrative compared to the six 2nd, 3rd and 4th place finishes I earned in 2017.

Struggling with weakened immunity and an endless string of illnesses throughout the year, I was disappointingly forced to withdraw pre-race (DNS) for the first time at the ITU Long Distance World Championship and Ironman 70.3 Los Cabos. I also finished outside the prize money for just the second time in my career (Ironman 70.3 Texas).

- US$0 – 9th at Ironman 70.3 Texas

- US$750 – 6th at Ironman 70.3 Ecuador

- US$1,250 – 4th at Ironman 70.3 Santa Cruz

- US$2,500 – 4th at Ironman 70.3 Cozumel

- US$2,750 – 2nd at Ironman 70.3 Campeche

- US$3,000 – 2nd at Ironman 70.3 Eagleman

- US$3,000 – 4th at Ironman 70.3 Pan American Championship – Monterrey

- US$3,250 – 3rd at Ironman 70.3 Mont Tremblant

- US$3,250 – 1st at Challenge Aruba

- US$19,750/CA$25,647 – Total

A post shared by Cody Beals (@cody.beals) on

As a side note, I’m disappointed by the fact that prize money at most races has remained flat. I don’t mind the fact that prize money is concentrated among fewer races, since this makes for more exciting, competitive and marketable events. I also welcome the ever increasing depth and caliber of pro triathlon. However, prize money has not kept pace with the development and value of the pro field and the sport in general. It’s a much taller order to earn a paycheck at races compared to the start of my career just four years ago. At the very least, we are overdue for a correction for inflation, for example, bringing a standard US$30,000 Ironman 70.3 prize purse to $35,000.

Other Non-Triathlon Income

For the third consecutive year, I derived the vast majority of my income from triathlon. I continued to keep my foot in the door with a small environmental science consulting firm, partly because I enjoy the intellectual change of pace from triathlon and partly to provide a measure of income security in the unlikely event that my triathlon career comes to an abrupt end.

Investments also continued to provide modest income. In the past, my portfolio consisted entirely of exchange traded funds and index funds, which are boring but suited my “couch potato” investing style. This approach served me well, despite barely mustering the interest to research and rebalance once or twice a year. Last year, I took greater interest in investing and waded into the riskier world of stocks and cryptocurrency. I had some great picks (Canopy Growth Corp, Ethereum, VeChain) and some regrettable ones (Cameco, Ripple, Nano/RaiBlocks), doing little better than my past hands-off approach.

Ways I do not and never will earn money include:

- government funding

- crowdfunding campaigns

- auctioning off race t-shirts and medals

- crushing local races

- PED dealing

Expenses

Triathlon Expenses

Triathlon-related expenses were slightly leaner than past years despite claiming a broader range of expenses for tax purposes. I included fuel and vehicle expenses for the first time, which are remarkably low on my newish Toyota Prius C. Equipment expenses could be even lower if I was less particular about my gear, often rejecting freebies in favour of buying the best. It’s also notable that I’ve spent ZERO on massage, physiotherapy and medical treatment over my entire career. This reflects both Canada’s outstanding public (socialist!) healthcare system and my durability as an athlete.

Travel expenses also remained minimal despite so many international trips. Most of my flights were generously covered by Giles Atkinson and Randy Stanfield, two of my earliest supporters. I also continued to benefit from the generosity of homestays, one of the highlights of my career. As I grow increasingly cantankerous and tender with age, I’m surprised to find my cheap ass willing to shell out a little more to avoid red eye flights and sketchy hotels. Crazy, I know!

Living Expenses

In previous budget posts, I’ve often alluded to my frugal, minimalist lifestyle and lean expenses. A decade of pathological cheapness thriftiness, financial restraint, saving and investing provided the financial footing for me to buy and renovate my first house. The past year marked quite a departure from past spending and saving habits as a result. Housing related spending was around ten times the previous year, including renovations but excluding my down payment. Other spending was perhaps even more restrained than usual.

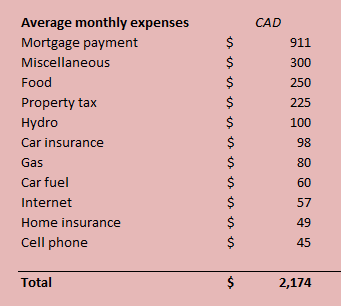

For the first time, I’m also sharing a breakdown of my estimated monthly living (non-triathlon) expenses for the coming year, once new home expenses have settled down. The “miscellaneous” category is a lowball estimate of everything else including home upkeep, car maintenance, clothing and hookers & blow entertainment.

Home Buying

Last year saw by far the biggest financial event of my life: the purchase and major renovation of my first home. I set out house hunting in September 2016, optimistically believing that I’d find my dream home, move in at the end of race season, and have everything squared away before the new year. Was I ever wrong!

I soon realized that the selection of homes in my price range—around CA$300,000—was limited, competition was fierce and properties tended to have a fatal flaw… or several. Four bedrooms and a garage in my budget? Either the realtor was setting up a bidding war or there was a yuuuge catch. I saw it all: floors off-kilter like a funhouse; ceilings that scraped my head; fresh paint poorly disguising mounds of mold; pest-eaten joists that crumbled to sawdust; and my all-time favourite, a leaking chasm in the foundation carefully tucked away behind a frilly curtain.

The struggle was exacerbated by an overheated seller’s housing market, especially within the ever expanding influence of the Greater Toronto Area. Multiple offers, no conditions, cash deals and absentee foreign buyers were the norm. One infuriatingly cute little Ikea commercial of a house had no fewer than 67 realtor cards on the table from showings and ended up going for 35% over asking!!

Qualifying for a mortgage as a pro triathlete is also no mean feat due to the unpredictable and volatile nature of my income. Despite demonstrating reasonable income and a large down payment, I still required the Bank of Mommy & Daddy to guarantee the mortgage. My broker joked about how many trees were killed to assemble the truckload of paperwork in my file.

After viewing over twenty homes and dodging a bullet with a scamtastic condo deal, all I had were dashed hopes, growing resentment and progressively lowered expectations.

Early one morning in January, as I did my customary compulsive hourly search of umpteen property websites, I came across an intriguing private sale. It was a small semi-detached century home in the heart of Guelph. It clearly needed some love, but with great bones, I saw it as a blank slate. I swore I’d never buy an old house after watching my parents’ never-ending battle to maintain their 150 year old Victorian farmhouse, but I fell in love with the house’s big windows, high ceilings, antique pine floors and many quirks.

The initial price was suspiciously low, which should have been my first red flag. Unfortunately, this is where the story takes a nasty turn. My lawyer would probably advise me to keep my mouth shut. Suffice it to say that the deal ended up taking thirteen months to close after countless delays and complications, all maddeningly beyond my control. The grand finale was a protracted legal dispute, narrowly avoiding a lawsuit, which was eventually resolved with conditions tantamount to extortion.

Long story short, I got the house. But only after over a year’s worth of stress, frustration, anger, sleepless nights and general disruption to my life including a six month stint squatting in a friend-of-a-friend’s basement.

As if this wasn’t enough to handle, I naively embarked on a massive renovation and restoration of the entire house. Despite what I thought was a meticulous reno budget, I was shocked by the myriad of unforeseen expenses and inevitable creep in the project’s scope. My original target of $25,000 snowballed to $50,000, not including the untold hundreds of hours of labor I’ve sunk into the house with the help of my parents.

- Home purchase price: $290,000

- Down payment: $100,000

- Mortgage: $190,000

- Renovations: ~$50,000

- Legal fees & other home setup costs: $5,000+

This crazy process underscored the importance of financial planning including maintaining a healthy emergency fund. By planning and buying conservatively, I was able to absorb costs that skyrocketed past my projections while maintaining at least twelve months of living expenses in savings. Admittedly, I’m still uncomfortable with my depleted savings and money has been on my mind more often than I’d like lately.

Now, with the dust finally settling, I’m grateful to have a home, but appalled by the toll it took on my time, energy, health, emotions, and finances. Working as a pro triathlete affords a lot of flexibility, but comes with some trade-offs. Pro triathlon is essentially a 24/7 commitment, more lifestyle than occupation. Performing at your best requires a stable environment with minimal distractions. It can be difficult to cope with other life stresses when you’re already pushing your body and mind to their limits, a hard lesson for me.

Concluding Thoughts

I’ve concluded all these budget posts on a similar note. Sure, my chosen career is far from straightforward and the demands and sacrifices dwarf the financial returns. But even looking back on a challenging year, my overwhelming sentiment is still gratitude. I get payed to do something that I’d be doing anyways, something that gets me up (gawdawful early) every morning, something that I find immensely satisfying and occasionally fun! Pro triathlon is far less glamorous than the casual observer may perceive, but I still remind myself how privileged I am to have this rare and thrilling opportunity.

I’m grateful for the support of my sponsors, Ventum, STAC Performance, Martin’s Family Fruit Farm, Skechers, EAS, Bliiq, Alto Cycling, Pioneer Power, Suunto, Keystone Communications (Giles Atkinson) and Randy Stanfield; my coach David Tilbury-Davis; my agent Claire Duncan; my family; and all of you following my adventures!